YEAR IN REVIEW:2022

01/19/2023

As with just about any year in real estate, the 2022 market had its highs and its lows. However, this year more than most, it may have been a tale of two very contrasting halves.

Thanks to the momentum during 2021, the year started off with high demand and extremely tight supply:

The Month’s Supply of Inventory (MSI) was at all-time lows in January (0.79), February (0.78), and March (0.88).

Three of the year’s first six months saw settled sales top 3,000: March (3,050), May (3,191), and June (3,320) each did, while none of the year’s final six months hit or surpassed that total.

Total settled sales for January through June were 16,872. For July through December, they totaled 14,875. That’s a difference of about 12%.

As is typical with any product, high demand and short supply pushed prices up.

The Median Sales Price (MSP) of homes in the Hampton Roads region was $291,000 for January, but quickly jumped up to a record high for the region of $328,797 in May.

That was a 13% increase in just four months.

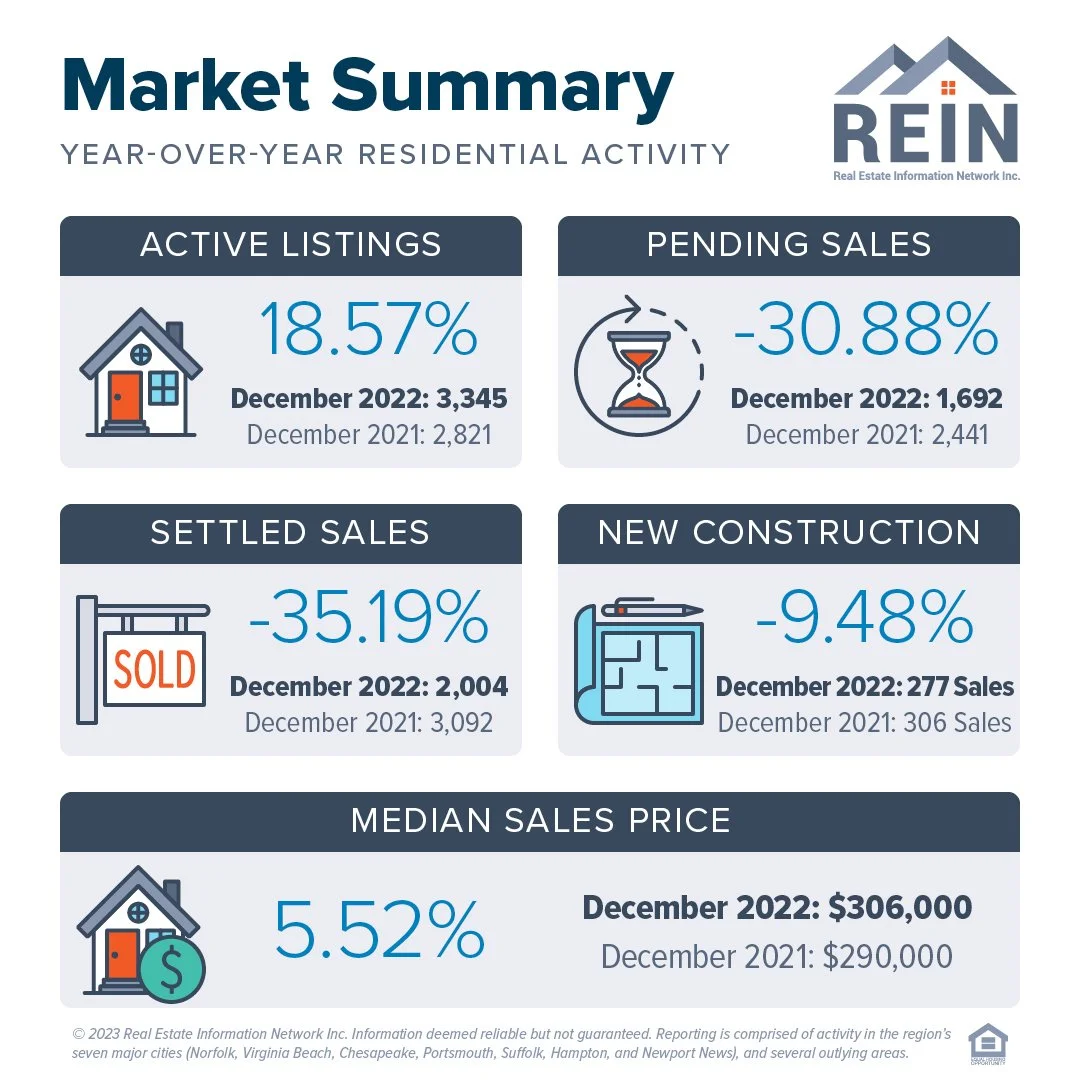

The MSP dropped steadily after May, falling to $302,000 in November, before rebounding a bit to $306,000 in December.

For the year, the MSP for the region overall was $312,000, a 7.2% increase from January to December.

While they are impacted by different factors, the total number of active listings recorded during the first six months was much lower than they were during the last six months.

For January through June, there were 18,555 active listings recorded.

For July through December, the number was 23,602, a difference of 27%.

The other data point that is often used to gauge the health of the market is Median Days on Market (DOM).

For the first six months of 2022, the Median DOM looked like this: 16, 11, 7, 7, 8, 9.

For July through December, they were 12, 15, 18, 19, 20, 24.

Clearly, the market slowed as the year went along - and for fairly obvious reasons.

First of all, prices climbed and peaked during May and June, pushing some potential buyers out of the market.

Inflation rates also impacted consumers. The inflation rate was 7.5% in January, jumped to 9.1% in June, and it ended the year at about 6.3% for December.

Finally, after dropping to historic lows in 2021, mortgage rates started 2022 as low as about 3% for a 30-year fixed-rate loan. However, rates climbed throughout the year. They were 4%-5% by March and hit 6%-plus in September, before topping out at more than 7% during parts of October and November. According to Freddie Mac the 30-year fixed rate averaged about 6.42% as 2022 ended.

Despite the challenges, 2022 still saw approximately 31,747 total closings take place. That’s the third highest in the region’s history – fewer than only 2021 (38,276) and 2020 (33,697).